- Higher rates are expected to lead to increased losses on banks’ bonds and contribute to financial pressures.

- KBW analysts Christopher McCratty and David Konrad estimated that banks’ earnings per share fell 18% in the third quarter.

- Earnings season kicks off on Friday with reports from JPMorgan Chase, Citigroup and Wells Fargo.

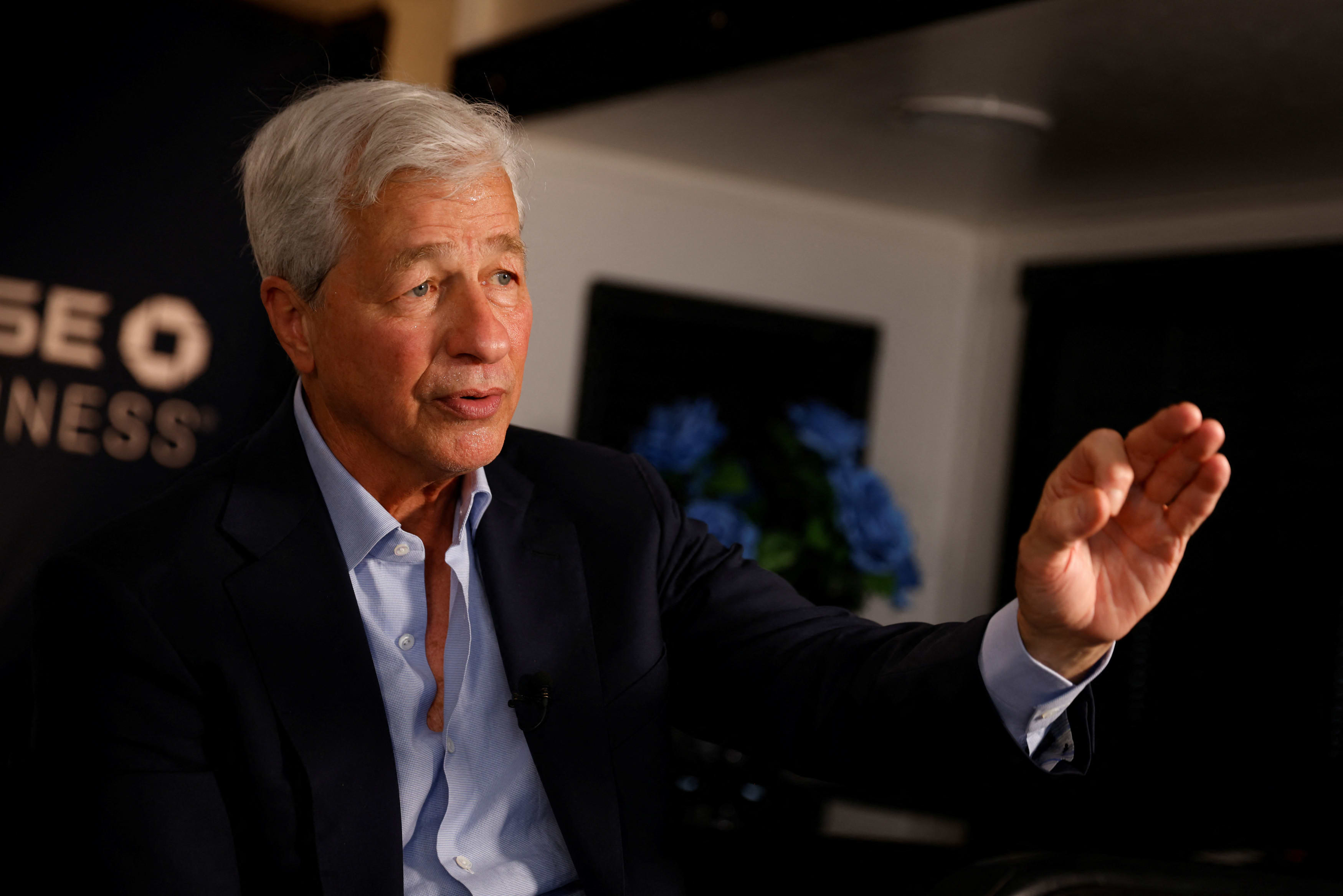

Jamie Dimon, chairman of the board and CEO of JP Morgan Chase & Co., gestures as he speaks during an interview with Reuters in Miami, Florida, U.S., on February 8, 2023.

Marco Bello | Reuters

U.S. banks are closing in on another quarter in which interest rates rose, reviving worries about contractions and rising loan losses — something some analysts see as a silver lining to the industry’s woes.

As they did during the March regional banking crisis, higher rates are expected to lead to increased losses on banks’ bond portfolios and contribute to financial pressures as firms are forced to pay higher rates on deposits.

KBW analysts Christopher McCratty and David Konrad estimated that banks’ earnings per share fell 18% in the third quarter.

“The fundamental outlook is tough over time; revenues are declining, margins are declining, growth is slowing,” McCratty said in a telephone interview.

Earnings season kicks off on Friday with reports from JPMorgan Chase, Citigroup and Wells Fargo.

Bank stocks have been closely intertwined with the trajectory of borrowing costs this year. Long-term interest rates, particularly the 10-year yield, rose 74 basis points in the quarter, and the S&P 500 banks index fell 9.3% in September on worries fueled by a surprise surge.

Rising yields mean bonds owned by banks fall in value, creating unrealized losses that squeeze capital levels. Earlier this year the movement caught mid-sized firms including Silicon Valley Bank and First Republic, which – along with deposits – led to government takeovers of those banks.

With the exception of Bank of America, the big banks have largely shrugged off concerns associated with underwater bonds. The bank piled on low-yield bonds during the pandemic and had more than $100 billion in paper losses on bonds. Mid year. The issue has curbed the bank’s interest income and made the lender the worst-performing stockbroker among the top six U.S. companies this year.

Expectations about the impact of higher rates on banks’ balance sheets varied. Morgan Stanley analysts led by Betsy Krasek said in an Oct. 2 note that second-quarter losses “more than doubled the estimated impact of the bond route in 3Q.”

The bond losses will have a profound impact on regional lenders including Comerica, Fifth Third Bank and KeyBank, Morgan Stanley analysts said.

However, other factors, including analysts at KBW and UBS, said the capital impact from higher rates could be reduced for most industries.

“A lot depends on the duration of their books,” Conrad said in an interview, referring to whether banks hold short- or long-term bonds. “I think bond scores will be similar to last quarter, it’s still a capital intervention, but there’s a small group of banks that are more vulnerable because of their own.”

There is also concern that higher interest rates will cause ballooning losses on commercial real estate and industrial loans.

“We expect loan loss provisions to increase compared to the third quarter of 2022 as we expect banks to build loan loss reserves,” RBC analyst Gerard Cassidy wrote in an Oct. 2 note.

However, bank stocks are primed for a short squeeze during the earnings season, as hedge funds bet on a rebound from the turmoil from March, when regional banks saw an outflow of deposits, UBS analyst Erika Najarian wrote in an Oct. 9 note.

“The combination of short interest above March 2023 levels and a short thesis by macro investors that higher rates will cause another liquidity crisis means the sector is set for volatile short pressure,” Najarian wrote.

According to Goldman Sachs analysts led by Richard Ramsden, banks will show stability in deposit levels during the quarter. That, along with guidance on net interest income for the fourth quarter and beyond, could support some banks, analysts at JP Morgan and Wells Fargo said.

Perhaps banking stocks have fallen so much and expectations are low that the industrial relief rally is due, McGratty said.

“People are looking forward, where is the revenue trough?” McGratty said. “If you think about the last nine months, the first quarter was very difficult. The second quarter was challenging, but not bad, and the third will be even more difficult, but again, not bad.”